Tuition Bills Increase When Paid Online

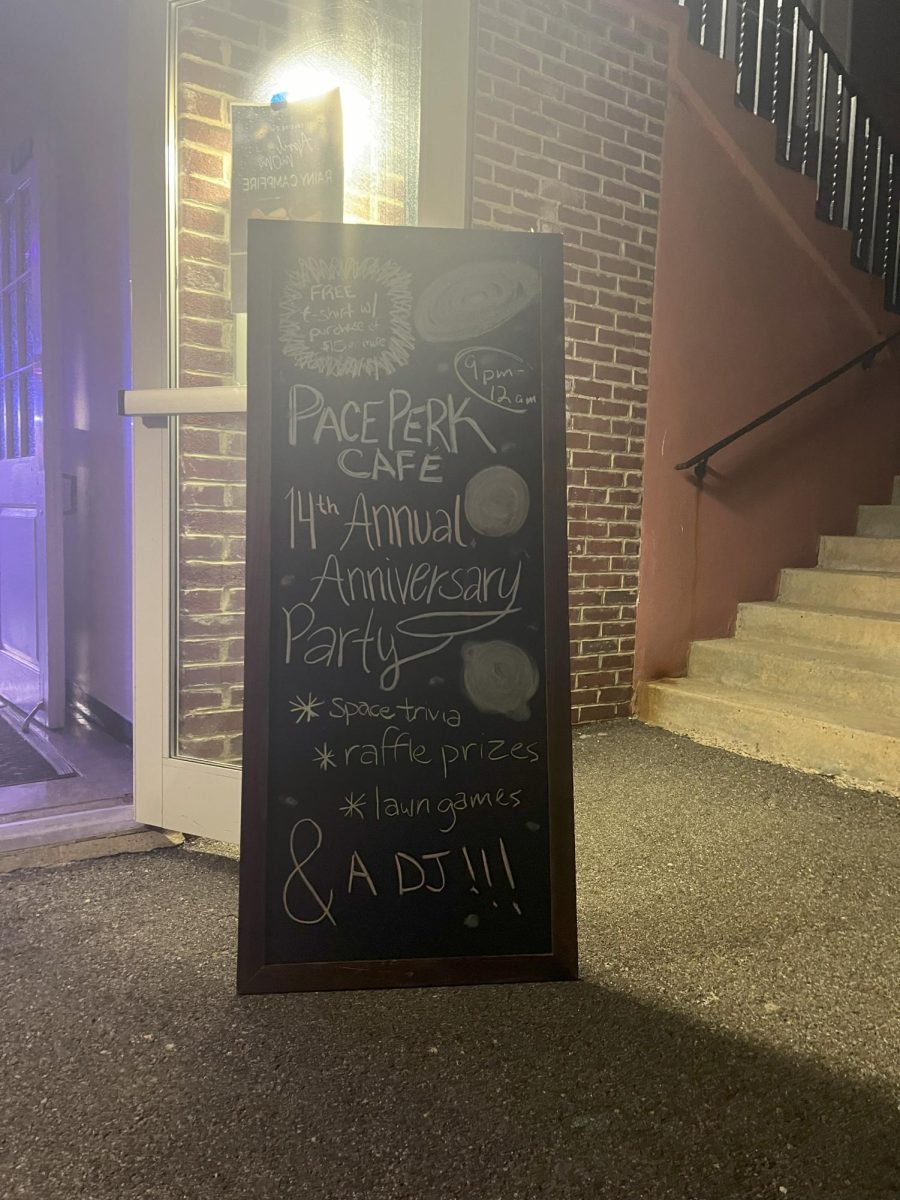

Hill that leads to the OSA and Financial Aid building, where bills are paid. Photo taken by Josiah Darnell.

December 1, 2018

Paying tuition bills should be a simple and easy process for students. A student just provides the money required for the balance given, whether it be through cash, check, or card.

The most common way to pay tuition bills is through the Office of Student Assistance (OSA). The services provided there will help finalize that process for students. However, in more recent years, OSA has gotten rid of the option to pay bills off through a card.

Students can no longer go to OSA to pay bills by card, no matter what card it is. Whether you have a credit card or debit card, it doesn’t matter because OSA denies them all. From now on, should a student want to pay their bill off by card, they have to go through the Pace Portal and pay it there.

According to OSA, this is a way to save time because you do not have to worry about standing in lines to do something that can be done from the comfort of your dorm room. It is enticing, and who would not want to get things done from a convenient location?

The catch to that is when paying bills online the school goes through a system known as Paypath. Because the school is using this system, their services have to be paid for. Whenever a payment is being made through Paypath, a service charge will be added to the total amount. The service is 2.85% making the minimum $3.00.

It may seem like a small amount, but for a college student, numbers mean everything and every penny matters. When budgeting out financial responsibilities, surprise charges like that can throw the balance of everything a student had calculated off.

Junior student Shariff Abukari had a balance that was over $361. He tried to pay his bill off online and when it was time to check out the bill ended up being $371. $10 more than he expected to spend. So instead of paying it online, he just went to the bank pulled the money out and paid it in cash. In doing so he only spent $361, which is what he intended to spend anyway.

Paying bills online can be a simple process but in the end, students will wind up paying more than expected. It is a more convenient way to get it done but saving those couple extra bucks will only do good. College students will always have some other financial aspect to cater towards and in this case, working smarter not harder is the best bet.

Mark Mangum • Dec 12, 2018 at 5:14 am

Good article. This brings to light the challenge of convenience and the cost associated with that convenience. One thing that I would like to see as an outcome to this article is for Pace to consider adjusting the bill in a way that does not increase the overall bill. Making it more convenient for all is a cost savings to Pace since in person overhead is reduced. Another approach would be to re-negotiate the paypath fee. As an Ipace student I don’t have a choice but to pay online.